Robo-Advisors: Are They the Future of Investments?

Investing has always been about making smart decisions, but technology is taking the reins in today’s fast-paced digital age.

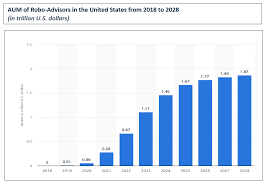

Enter Robo-advisors—automated platforms designed to simplify investing using algorithms to create and manage portfolios. Over the past decade, these platforms have experienced explosive growth, with global assets under management surpassing $1 trillion in 2023, and projections suggesting this figure will double by 2025.

Traditional investing often comes with high fees, complex processes, and a steep learning curve, leaving many individuals hesitant to start. Robo-advisors are changing the game by making investing more accessible, affordable, and efficient. They cater to modern investors who value convenience and data-driven strategies.

This blog explores the rise of Robo-advisors, their benefits and challenges, and whether they truly represent the future of investments. Whether you’re new to investing or seeking smarter ways to grow your portfolio, this is your guide to understanding the Robo-advisor revolution.

As Robo-advisors reshape the investment landscape, artificial intelligence is driving even bigger changes in the fintech industry. From fraud detection to automated trading, AI is revolutionizing how we manage money.

Read Our Blog on AI in Fintech to see how AI is transforming finance and what it means for the future of investing!

What Are Robo-Advisors?

Robo-advisors are transforming the way people invest by automating portfolio management. They are online platforms that use advanced algorithms to manage investments, removing the need for a traditional human advisor. These tools provide a simple and cost-effective way to grow wealth, making investing accessible to everyone.

Definition and Overview

A robo-advisor is an automated platform that helps manage your investments based on your financial goals and risk tolerance. By leveraging algorithms and data, these tools create and maintain diversified portfolios without the emotional biases of human decision-making.

- Example: Platforms like Betterment and Wealthfront have gained popularity for offering automated, low-cost investment solutions. A user provides information about their goals, such as saving for retirement, and the robo-advisor handles the rest—from asset allocation to rebalancing.

Why They Matter: Robo-advisors democratize investing, making it easy for anyone, regardless of experience or wealth, to start building their portfolio.

How Do They Work?

Robo-advisors follow a straightforward process to help users invest effectively:

User Inputs

- The user provides basic information like their financial goals, investment timeline, and risk tolerance.

- Example: A user indicates they want to save for retirement in 20 years and prefer moderate risk.

Goal Setting

- The platform uses this information to set specific investment objectives, such as growing wealth or generating income.

Portfolio Allocation

- Based on the user’s profile, the robo-advisor builds a diversified portfolio. It invests in a mix of assets, such as stocks, bonds, and ETFs, tailored to the user’s preferences.

Rebalancing

- Over time, market fluctuations may cause the portfolio to drift from its original allocation. Robo-advisors automatically rebalance the portfolio to maintain the desired mix.

- Example: If stocks outperform bonds, the platform may sell some stocks and buy bonds to restore balance.

Why It Works: This hands-off approach ensures consistent alignment with your goals, even as markets change.

Benefits of Robo-Advisors

Robo-advisors have become a popular choice for investors seeking simplicity, efficiency, and cost-effectiveness. Here’s a look at their key benefits.

1. Low Fees and Accessibility

One of the biggest advantages of robo-advisors is their affordability compared to traditional financial advisors. Robo-advisors charge significantly lower fees, typically ranging from 0.25% to 0.50% annually, compared to the 1% or more charged by human advisors.

As we see, Betterment charges just 0.25% annually, making professional portfolio management accessible even to those with smaller investment amounts. Low fees mean more of your money stays invested, helping your portfolio grow faster over time.

2. Automated and Data-Driven Decisions

Robo-advisors rely on algorithms to make rational, data-driven investment decisions. Algorithms analyze market trends and investment patterns, removing emotional bias like fear or greed from the equation.

By sticking to proven strategies, robo-advisors help investors avoid common mistakes such as panic selling during market dips. Automated decisions ensure consistency and efficiency, even during volatile market conditions.

3. 24/7 Portfolio Monitoring

Robo-advisors continuously track your portfolio, making adjustments as needed to keep it aligned with your goals.

These platforms monitor investments round-the-clock and rebalance portfolios when market fluctuations cause asset allocations to drift.

Example: During a sudden market drop, a robo-advisor can automatically shift investments to safer assets, reducing potential losses.

Why It Matters: This hands-free approach ensures your portfolio remains optimized without requiring constant attention from you.

Drawbacks of Robo-Advisors

While robo-advisors offer many benefits, they’re not without limitations. Understanding these drawbacks is essential for making informed investment decisions.

1. Lack of Personalization

Robo-advisors are designed to provide generalized solutions, which may not address unique or complex financial needs.

- The Challenge: Standardized investment plans may not suit individuals with intricate financial situations like estate planning, tax optimization, or managing multiple income sources.

- Example: A high-net-worth individual seeking tailored advice on transferring wealth to heirs may find robo-advisors inadequate for their needs.

Why It Matters: Investors with specific goals or complex finances may need the personalized touch that only a human advisor can provide.

2. Limited Human Interaction

Robo-advisors lack the personal connection that comes with working directly with a financial advisor.

- The Challenge: Some investors value direct conversations with a human advisor who can offer reassurance, answer detailed questions, or provide emotional support during volatile markets.

- Example: During a market downturn, an investor might prefer a discussion with an advisor to address concerns, which robo-advisors cannot offer.

Why It Matters: The absence of human interaction can leave some investors feeling disconnected or unsupported.

3. Over-Reliance on Algorithms

Robo-advisors depend entirely on algorithms, which can sometimes lead to unintended outcomes.

- The Challenge: Algorithms, while efficient, may misinterpret data or struggle during unpredictable market events. They cannot account for every nuance, such as geopolitical crises or unexpected economic changes.

- Example: During a sudden market crash, an algorithm might overreact or fail to adapt quickly, leading to suboptimal decisions.

Why It Matters: Over-reliance on algorithms can expose investors to risks during extreme market conditions.

Robo-advisors provide convenience and cost savings, but they have their limitations. They may not be suitable for complex financial needs, lack the personal touch of a human advisor, and can be vulnerable to algorithmic errors. Investors should weigh these drawbacks carefully and consider combining robo-advisors with human expertise when necessary.

Robo-Advisors vs. Traditional Financial Advisors

Choosing between robo-advisors and traditional financial advisors depends on your investment needs, goals, and preferences. Here’s how they compare and when each option is best suited for you.

1. Key Differences

Robo-advisors and traditional advisors differ in several critical areas, including cost, accessibility, and level of service. Here’s a side-by-side comparison:

| Feature | Robo-Advisors | Traditional Financial Advisors |

|---|---|---|

| Cost | Low fees (0.25%–0.50% annually) | Higher fees (1% or more annually) |

| Accessibility | Available online 24/7 | Limited to office hours or scheduled meetings |

| Level of Personalization | Standardized solutions | Tailored advice for complex financial situations |

| Human Interaction | No direct contact, fully automated | Direct conversations and emotional support |

| Ideal For | Beginners and passive investors | Investors with complex needs, such as estate planning |

Example: A young professional just starting their investment journey might prefer a robo-advisor for its low costs and simplicity, while someone managing a multi-million-dollar portfolio may benefit from a traditional advisor’s expertise.

2. When to Choose Robo-Advisors

Robo-advisors excel in specific scenarios where simplicity and affordability are priorities.

- For Beginners:

Robo-advisors are ideal for first-time investors who need guidance but don’t want to spend too much on fees.

Example: A college graduate with $1,000 to invest can start with a robo-advisor like Betterment. - For Passive Investors:

Those who prefer a hands-off approach will appreciate the automation and low maintenance of robo-advisors.

Example: Busy professionals who don’t have time to actively monitor investments. - For Simple Financial Goals:

Robo-advisors work well for straightforward objectives like retirement savings or building a diversified portfolio.

Example: Someone planning to retire in 20 years can set their goal, and the robo-advisor will handle the rest.

Robo-advisors and traditional financial advisors each have their strengths. Robo-advisors are perfect for beginners, passive investors, or those with simple goals, offering affordability and ease of use. Traditional advisors, however, shine in complex financial planning and personalized service. Choose the option that best aligns with your needs and investment style.

Popular Robo-Advisors in 2025

Robo-advisors are dominating the investment landscape in 2025, with several platforms standing out for their features and affordability. Let’s explore the leading platforms and compare their offerings.

1. Leading Platforms

Here are four popular robo-advisors reshaping the investment world in 2025:

Betterment:

- What It Offers: Low-cost portfolio management, goal-setting tools, and tax-loss harvesting.

- Best For: Beginners and investors focused on retirement planning.

Wealthfront:

- What It Offers: Automated financial planning, tax-efficient investing, and custom portfolios.

- Best For: Tech-savvy investors seeking comprehensive features.

Vanguard Digital Advisor:

- What It Offers: Portfolio management with a focus on low-cost index funds.

- Best For: Passive investors who prioritize long-term growth.

SoFi Invest:

- What It Offers: No management fees, access to financial planners, and additional perks like career coaching.

- Best For: Millennials looking for a low-cost, versatile platform.

2. Features and Fees Comparison

Here’s a quick comparison of the leading platforms:

| Platform | Management Fee | Minimum Investment | Key Features |

|---|---|---|---|

| Betterment | 0.25% annually | $10 | Tax-loss harvesting, goal tracking |

| Wealthfront | 0.25% annually | $500 | Advanced tax strategies, customizable portfolios |

| Vanguard Digital Advisor | 0.15% annually | $3,000 | Focus on low-cost index funds, long-term planning |

| SoFi Invest | $0 | $1 | Free access to planners, career coaching benefits |

Takeaway: Choose the platform that aligns with your financial goals, fee tolerance, and desired features.

Growth Statistics and Adoption Trends

Robo-advisors are not just a trend—they’re becoming a cornerstone of modern investing. Here’s how their popularity is growing.

1. Rising Popularity of Robo-Advisors

- Market Growth: The global robo-advisor market is expected to surpass $2 trillion in assets under management by 2025, highlighting their rapid adoption across investor segments.

- Key Drivers: Low fees, accessibility, and automation have made robo-advisors an attractive option for investors of all experience levels.

2. Adoption Among Millennials and Gen Z

Younger generations are leading the shift toward robo-advisors due to their preference for digital-first solutions.

- Why It Matters: Millennials and Gen Z value affordability, convenience, and technology-driven platforms, making robo-advisors an ideal fit.

- Example: Platforms like SoFi Invest and Wealthfront attract younger users with no minimum fees, mobile apps, and financial planning tools.

Insight: Younger investors are driving the demand for innovative features and digital accessibility in investment platforms.

Robo-advisors are becoming indispensable tools for modern investors. Platforms like Betterment, Wealthfront, Vanguard Digital Advisor, and SoFi are leading the charge, offering diverse features to meet various needs. With their rising popularity among Millennials and Gen Z, robo-advisors are set to redefine the future of investing.

Are Robo-Advisors Right for You?

Deciding whether to use a robo-advisor depends on your investment style, financial goals, and personal preferences. Let’s explore who benefits most and what factors to consider.

1. Who Benefits Most?

Robo-advisors are ideal for specific types of investors:

- Passive Investors:

Those who prefer a hands-off approach to investing can benefit from automated portfolio management and rebalancing.

Example: A busy professional who doesn’t have time to monitor the market. - Tech-Savvy Individuals:

Investors comfortable using digital platforms and apps will appreciate the seamless experience offered by robo-advisors. - Straightforward Goals:

Robo-advisors excel in managing simple objectives like retirement savings or building a diversified portfolio.

Example: Someone saving for a down payment on a house in the next 5 years.

2. Factors to Consider

Before choosing a robo-advisor, think about:

- Investment Goals:

Are your goals straightforward, or do you need more complex financial planning? - Complexity of Finances:

If your finances involve estate planning, tax strategies, or multiple income streams, a traditional advisor might be a better fit. - Need for Personalized Advice:

Robo-advisors offer standardized solutions, so consider whether you need one-on-one guidance.

Insight: If your needs are simple and you value cost-effectiveness, robo-advisors are a great choice. For complex financial goals, consider a hybrid approach with human advisors.

The Future of Robo-Advisors

Robo-advisors are constantly evolving, driven by advancements in technology and global trends. Here’s a glimpse into what’s next.

1. Integration of AI and Machine Learning

AI and machine learning will take robo-advisors to the next level.

- What to Expect: Enhanced predictive analytics that can identify market trends and suggest better investment strategies.

- Example: AI algorithms predicting sector growth, enabling more precise portfolio adjustments.

Why It Matters: These advancements will make robo-advisors smarter and more effective, even in volatile markets.

2. Hybrid Models

The future may see a blend of automation and human expertise.

- What to Expect: Robo-advisors working alongside human advisors to provide personalized advice for complex situations.

- Example: A robo-advisor handling day-to-day portfolio management while a human advisor offers tax and estate planning services.

Why It Matters: Hybrid models combine the best of both worlds—cost-effective automation and tailored human guidance.

3. Global Expansion

As digital platforms become more accessible, robo-advisors will expand into emerging markets.

- What to Expect: Greater adoption in regions where traditional financial services are less accessible or too expensive.

- Example: In countries with growing middle classes, robo-advisors can democratize investing for first-time investors.

Why It Matters: Global expansion will increase financial inclusion and help more people grow their wealth through automated solutions.

Robo-advisors are ideal for passive investors and those with straightforward financial goals, offering cost-effective and automated solutions. As AI evolves and hybrid models emerge, robo-advisors will become even more powerful, blending technology with human expertise. With global expansion on the horizon, the future of robo-advisors is bright and inclusive, reshaping how the world invests.

Simplifying Investments with Robo-Advisors

Robo-advisors are changing the way people invest by making it simple, affordable, and accessible to everyone. They offer low fees and automated solutions, making them perfect for passive investors and those with straightforward goals.

As technology advances, robo-advisors will become even smarter, combining AI with human expertise and expanding to new markets. Whether you’re new to investing or looking for a hands-off approach, robo-advisors could be the right choice to grow your wealth.